Introduction

Navigating through Indian import regulations can be a daunting task, especially for businesses looking to expand their reach in the vibrant Indian market. Understanding the intricacies of import regulations is crucial for a seamless and successful entry into the country. In this comprehensive guide, we will break down the key aspects of Indian import regulations, providing you with the knowledge needed to navigate through the complexities.

Understanding the Basics (H2)

What Are Import Regulations? (H3)

Import regulations refer to the set of rules and requirements imposed by the Indian government on the importation of goods and services. These regulations are designed to ensure the safety, security, and compliance of imported products with Indian standards.

Importance of Compliance (H3)

Compliance with import regulations is not just a legal requirement; it is a key factor in building trust with Indian authorities and consumers. Non-compliance can lead to delays, fines, or even a halt in operations.

Key Components of Indian Import Regulations (H2)

Tariffs and Duties (H3)

Navigating Indian import regulations starts with understanding the tariffs and duties applicable to your products. We’ll delve into the common tariff structures and how to calculate duties accurately.

Documentation Requirements (H3)

Accurate and complete documentation is crucial for a smooth import process. We’ll discuss the essential documents required and tips for preparing them efficiently.

Restricted and Prohibited Items (H3)

Certain goods are restricted or prohibited from being imported into India. We’ll provide insights into these items and how to navigate the regulatory landscape surrounding them.

Custom Valuation (H3)

Understanding how customs value goods is vital for calculating accurate duties. We’ll guide you through the intricacies of custom valuation and its impact on your import costs.

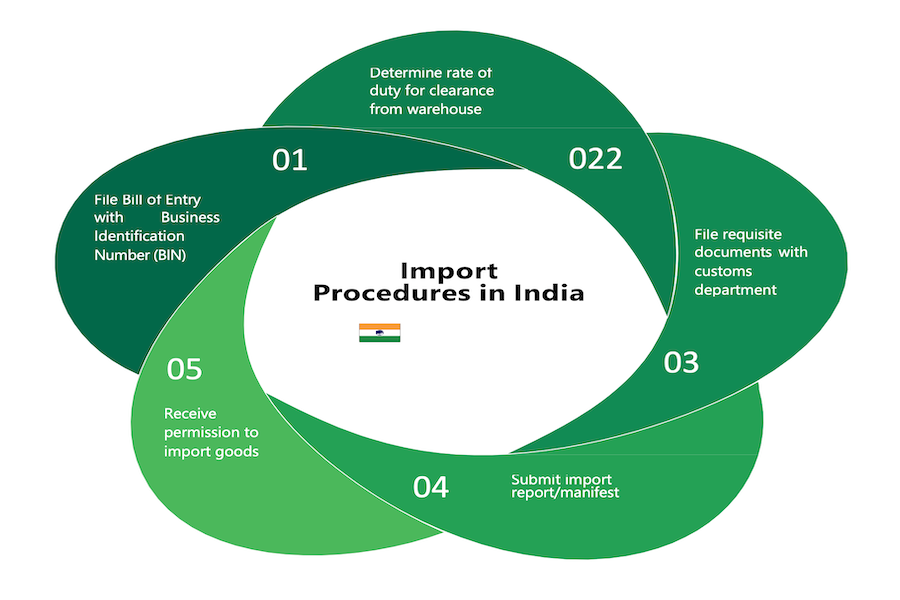

Step-by-Step Guide to Importing into India (H2)

Step 1: Research and Planning (H3)

Before diving into the import process, thorough research and strategic planning are essential. We’ll discuss market analysis, product classification, and choosing the right entry points.

Step 2: Registration and Licensing (H3)

Navigating Indian import regulations requires businesses to obtain the necessary licenses and registrations. We’ll outline the process and key requirements.

Step 3: Customs Clearance (H3)

Customs clearance is a critical step in the import process. We’ll provide a detailed guide on the documentation needed and the customs clearance procedure.

Step 4: Compliance with Standards (H3)

Ensuring your products meet Indian standards is crucial. We’ll explore the certification process and how to comply with regulatory standards.

Challenges and Solutions (H2)

Common Challenges in Importing to India (H3)

From bureaucratic hurdles to cultural differences, we’ll highlight the common challenges businesses face when navigating Indian import regulations.

Solutions for a Smooth Import Process (H3)

Practical solutions to overcome challenges, including engaging local experts, leveraging technology, and building strong relationships with Indian partners.

Conclusion

Navigating Indian import regulations may seem like a complex puzzle, but with the right knowledge and preparation, it can be a rewarding experience. By understanding the basics, key components, and following a step-by-step guide, businesses can successfully navigate the Indian import landscape.

Frequently Asked Questions (FAQs)

- Do I need a local partner to navigate Indian import regulations?

- While not mandatory, having a local partner can provide valuable insights and streamline the process.

- What are the penalties for non-compliance with Indian import regulations?

- Penalties may include fines, delays, or even a temporary halt in importing activities.

- How can I stay updated on changes in Indian import regulations?

- Regularly checking official government websites and consulting with local experts can help you stay informed.

- Are there specific regulations for importing certain types of products, such as electronics or pharmaceuticals?

- Yes, certain industries may have additional regulations, and it’s crucial to research and comply with sector-specific requirements.

- Is it possible to expedite the customs clearance process in India?

- While it may not be expedited, thorough preparation and accurate documentation can help speed up the customs clearance process.

Add comment